What's the first and most important question you should ask about any new business? In my view it's: “Is the business making money?”. In order to know that you need to know three numbers:

- The Customer Acquisition Cost (CAC)

- The Cost of Goods Sold (COGS)

- The Customer Life Time Value (LTV)

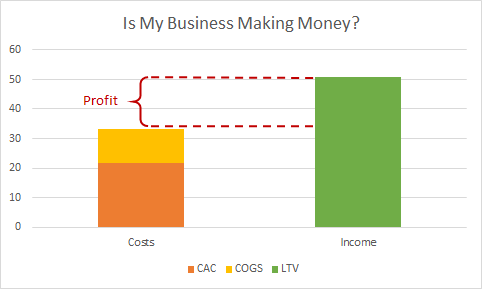

And you need to know that CAC + COGS is less than LTV. If it is then you're in business, if it isn't then what you have isn't a business, it is an expensive hobby.

I'm going to tell you what these metrics are, how to work them out simply and what to do when you know the answer.

Customer Acquisition Cost (CAC)

This means: “How much did it cost me to find each customer?”.

The simplest way to calculate this is to take the amount you spent on marketing activity, divided by the number of new customers that you had.

You could try and get more sophisticated than that, but don't to begin with. I'd recommend you work this out every month, but averaged over the previous 3 months. This irons out any anomalies in your spending and gives you a more reliable number. This is how much it is costing you to recruit each customer and is therefore your best guess as to how much it will cost to recruit new customers in the future.

Customer Life Time Value (LTV)

Once you've got someone to buy from you, how much do they spend?

How you work this out will depend a little bit on your business model. If you run a subscription dating website, then you have money automatically coming in every month from each member. If you sell batteries on eBay, then it makes no difference whether someone has bought from you before – you have to re-acquire the same people every time they buy.

In between subscription dating and eBay batteries, there are a million shades of grey. Once a hair stylist, massage therapist or domestic cleaner acquires a new customer, that customer doesn't have to be marketed to each month. But is the same true of a coffee shop or a specialist sport equipment retailer? Brand loyalty is hard to quantify and is something you could hire me to worry about if you really want to.

Let's keep things simple for now. Decide whether you have a recurring business or not. If you don't then assume that buying from you once is no indication of future behaviour. In which case your customer lifetime value is just the average amount spent in any one transaction.

If you do have a recurring business, then work out the average number of months that a person remains your customer for and then multiply that by the average that each customer spends each month.

If you've only just started, you won't really know how long people are going to remain your customers for. Someone like me could predict it based on your “churn rate” or industry standard metrics, but if you need to, just take a guess and come back to it in 6 months when you have some more reliable data.

You should now have a figure for how much money you get from a customer once you've recruited them.

Cost of Goods Sold (COGS)

This is how much it's going to cost you to supply all of the raw materials and labour for each new customer that you acquire. If you make software, music, books, movies or drugs then you can skip the next few paragraphs. The answer is “almost £0”. That's not to say you don't have expenses, it's just that those expenses are not influenced by how many customers you serve.

If you're selling something physical or something that requires a significant amount of someone's time to deliver, then the cost of supplying each new customer needs to be added to the cost of acquiring that customer.

Ask yourself, if 100 new customers showed up tomorrow, what would I have to buy? Add that all up, divide it by 100 and that's your COGS.

Bringing it Together

Now add your COGS to your CAC and compare it to your LTV. Here's a chart of the ideal result:

Actionable Insights

Businesses are like little machines that take in money and spit out more money. If CAC + COGS is £50, but LTV is £100, then the actionable insight is that you should spend more on marketing. You'll acquire more customers and double your money!

If CAC + COGS is a bit higher than LTV then you need to look for ways to decrease COGS, decrease CAC or increase LTV, whichever is easier. You can't carry on like that forever.

If CAC + COGS is a lot higher than LTV, then stop. Regardless of any sunk costs or damaged egos. The longer you go on the more money you're going to lose.

In Summary

What I do is quite geeky. I pore over databases and spreadsheets. I sweat over the best way to calculate certain metrics and I write code to crunch numbers. I'm a details guy. But when it comes to showing the results of my work, I know that simplicity is best. What's needed is Actionable Insight, not hundreds of impressive looking charts. In my view, businesses need to focus on the metrics that matter, and get those right first. If you're starting a new venture and you only had one monthly report, then it should be this one. There's plenty of complexity and details to get into if you want to, but the question of whether or not your business makes money is more important than anything else.