Anyone who's ever had to justify a marketing budget will be all too familiar with the words "Return On Investment" or ROI. Whether you're doing direct mail, TV ads or Social Media, marketers in almost every business, sector and channel must show that their campaigns are generating a return otherwise their budgets may be under threat. To marketers who love number crunching and spreadsheet building this probably isn't a problem, but for some, reporting ROI is a bit of a nightmare.

The Web Makes this Easy Right?

Since the birth of the web, marketing has become dominated by the availability of (and the need to make sense of) a huge quantity of data. Rather than having to go out searching for data. Digital marketing is characterised by the availability of vast amounts of data and a multitude of tools for making sense of it. It can be quite daunting.

But while the web gives you many easy ways to measure how much attention your digital campaign generated such as impressions, likes, follows, clicks, enquiries or trials signups, that's only half the story. What you really need to measure is revenue.

You can't calculate ROI without measuring revenue.

Understanding how much of your attention turned into actual revenue is surprisingly unchanged by the web. If you sell products online, then it is at least possible to track purchases in Google Analytics but that doesn't come out of the box and it's not always that easy to set up. If you close your sales offline, then measuring revenue relies on delving into CRM databases or accounting systems. This was part of my motivation for building QueryTree, marketers needed a way to extract transaction data from back end systems so they could work out their revenue.

Turning Revenue into Lifetime Value

Once you've figured out where your customers came from and how much they've spent, you could just add up the total revenue from each campaign and check it's more than what you spent on that campaign. But that would be selling yourself short. All that marketing effort didn't just result in a few months worth of revenue, you've acquired some new customers and those customers will (hopefully) continue to bring in revenue for months or years to come. Understanding ROI means knowing how much those customers will be worth in the future too.

You need to calculate the Lifetime Value (LTV) of your newly acquired customers.

The Simple Way

You could take all the revenue that your business has generated since it started, and divide that by the number of unique customers that you've had during that time. They will give you the average revenue per customer so far. If you've been running for a few years and haven't had any recent changes to your business model or number of customers then that approach could be OK.

Cohort Analysis

If you've recently acquired a lot of new customers the simple approach won't really work, the revenue from the older customers will be divided over all those recently acquired customers and the average will be too low. One way around this would be to look at a specific set of long standing customers and work out what their average revenue was. For example, you could find all the customers that you acquired in 2012, how much they've spent since then, and divide that by the number of customers in that group. This kind of Cohort Analysis is quite powerful, but it takes a long time for changes in your business model to affect your numbers, because you're only ever looking at old data.

Predicting the Future

If you have an idea of how many of your customers you're currently retaining from month to month, and you know what the average customer currently spends in each month, then you don't have to wait a few years to see what a particular cohort did, you can predict what the current cohort will do:

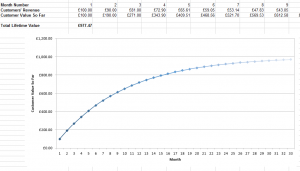

Let's say your customers are spending £100 per month on average, and from month to month you retain 90% of those customers. When you acquire a new customer you'll get roughly £100 off them in that month. Then, in the second month, there's a 90% chance you'll get another £100.

Now, for each individual customer you'll either get the £100 in month two or you won't. You can't have 90% of a customer. But assuming we started with a large number of customers in month one, we can pretend that each customer in month one is worth 90% of a customer in month two.

So we can predict we'll get £90 off our “average customer” in month two. Then £81 in month three. £72.90 in month four. And so on until we're eventually getting £2.50 off our average customer in month 36. Adding up the total revenue from that customer over three years comes to around £977. You could keep going if you like, but three years is probably the limit to what is sensible.

Here's a spreadsheet you can download and which illustrates that concept, feel free to enter your own retention and monthly revenue figures to measure your own LTV.

Are You Sure You Want to Measure ROI?

Some marketers wonder whether there's more to marketing than ROI. Rebecca Lieb writes a thought provoking article suggesting that, while accountability is important, other metrics might be more sensible for some campaigns. I agree with many of these sentiments, building a brand and relationships with customers is a hugely valuable in ways that are often impossible to quantify, or don't pay off straight away. But the realities of the corporate boardroom mean that ROI, and other hard metrics, will always be important. So there's no escape from measuring ROI (and therefore revenue) just yet.